In the 1980’s, a major oil company hired me to seek out 30 locations for a new business they had entered: office products. The company’s head of real estate told me that he wanted me to negotiate 30 leases across the US. The catch? He wanted each one to have an annual cancellation clause. I had never heard of a request like this, and actually told him that it was impossible; no landlord would ever give that type of concession. His answer was simple: “For the right price, they’ll give us anything.”

As a result, I spent several months negotiating leases across the United States for this operation. In some cases, the cancellation amounted to the discounted value of the remainder of the lease term. In other cases, it was as low as the price of 2 months’ rent. I accomplished what the oil company had asked for, and both of us went our separate ways.

Interestingly enough, about 3 years later, I was contacted again by this same Director of Real Estate with the task of canceling all of the leases. The company had decided to abandon the manufacturing and selling of office products (not a surprise). What was fascinating to me was that I was able to successfully terminate every one of the leases I had negotiated, at a cost far below what the user would have experienced had they tried to sublease each of the spaces.

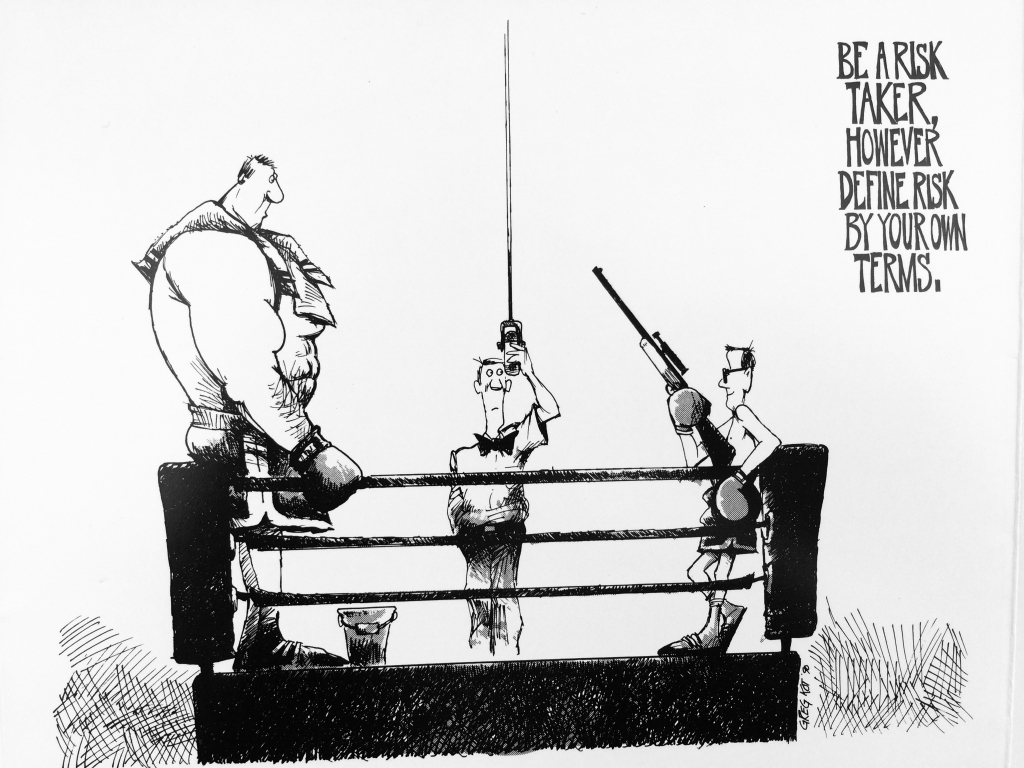

This experience taught me that hedging of risk – business, market, and building risk – is the key to a viable lease. Needless to say, the ability to hedge risks through options is quite (if not more) distasteful to building ownership than any other type of concession they may give. This is because it is basically a one-way street in favor of the tenant.

Clearly, not all landlords are willing to allow tenants to hedge their risks. That said, one key criteria early on in the search for office space might be the user’s need to hedge risk. From there, one can determine, based on market conditions, which landlords will consider working on this.

Working with a think tank from the University of Chicago, my company developed a method for evaluating the cost of risk in leases. While our clients in the securities industry are the largest users of this service, the fact is that risk can be associated with a cost for any industry.

We even took it one step further at Howard Ecker + Company. We have a method for financially participating in hedging of this risk on behalf of our clients. To my knowledge, we are the only firm in the country that does. If this is something that interests you, I would be happy to share our approach in greater detail.